All about Real Estate Reno Nv

All about Real Estate Reno Nv

Blog Article

Excitement About Real Estate Reno Nv

Table of ContentsSome Of Real Estate Reno NvHow Real Estate Reno Nv can Save You Time, Stress, and Money.Not known Incorrect Statements About Real Estate Reno Nv The 7-Second Trick For Real Estate Reno Nv

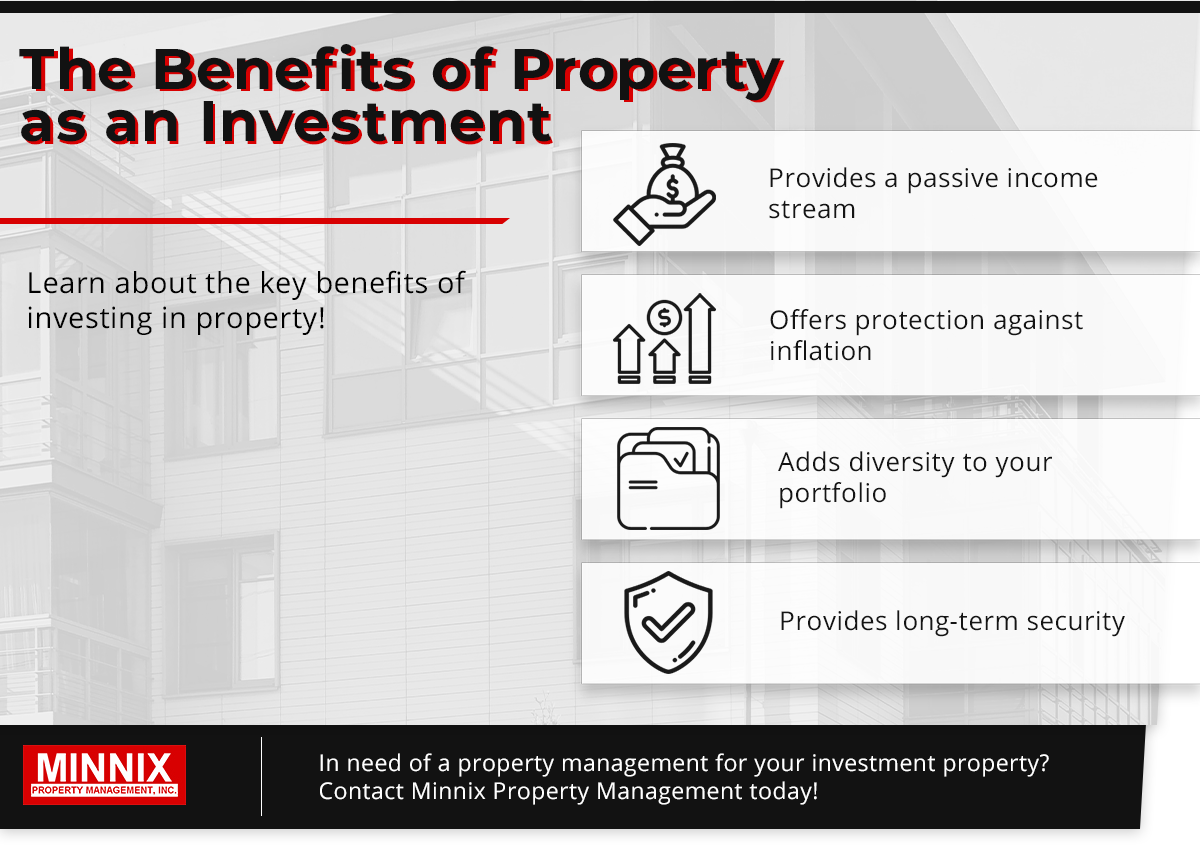

That might appear costly in a world where ETFs and mutual funds might bill as little as absolutely no percent for creating a diversified profile of supplies or bonds. While platforms might vet their investments, you'll have to do the very same, which suggests you'll require the skills to analyze the opportunity.Like all investments, actual estate has its pros and disadvantages. Long-term appreciation while you live in the residential or commercial property Prospective bush versus rising cost of living Leveraged returns on your financial investment Passive revenue from rental fees or with REITs Tax benefits, consisting of rate of interest reductions, tax-free funding gains and devaluation write-offs Repaired long-term financing available Appreciation is not ensured, particularly in economically depressed locations Residential or commercial property rates might fall with greater rate of interest prices A leveraged financial investment implies your down settlement is at threat Might need significant time and money to manage your own residential properties Owe a set home loan repayment every month, even if your renter doesn't pay you Lower liquidity for genuine property, and high compensations While real estate does use lots of benefits, specifically tax obligation benefits, it doesn't come without substantial disadvantages, in particular, high commissions to exit the market.

Do you have the resources to pay a home loan if a lessee can't? Just how much do you rely on your day job to keep the investment going? Readiness Do you have the wish to act as a property owner? Are you ready to collaborate with lessees and understand the rental legislations in your area? Or would certainly you like to examine offers or investments such as REITs or those on an on the internet platform? Do you wish to satisfy the needs of running a house-flipping business? Understanding and skills While lots of financiers can find out at work, do you have unique skills that make you better-suited to one kind of financial investment than an additional? Can you evaluate supplies and build an appealing portfolio? Can you fix your rental residential property or deal with a fin and conserve a bundle on paying experts? The tax obligation advantages on realty vary widely, relying on just how you spend, yet spending in real estate can provide some substantial tax obligation advantages. Real Estate why not find out more Reno NV.

Real Estate Reno Nv for Dummies

REITs provide an attractive tax profile you will not sustain any type of capital obtains tax obligations till you market shares, and you can hold shares literally for years to avoid the tax guy. In reality, you can pass the shares on your successors and they will not owe any kind of tax obligations on your gains.

Property can be an attractive financial investment, but investors desire to make certain to match their sort of investment with their willingness and capability to handle it, consisting of time dedications. If you're seeking to create earnings during retirement, realty investing can be one means to do that.

There are numerous advantages to buying genuine estate. Constant earnings circulation, strong returns, tax benefits, diversification this hyperlink with appropriate properties, and the capacity to take advantage of wealth with realty are all benefits that investors may appreciate. Below, we explore the numerous benefits of purchasing actual estate in India.

Not known Details About Real Estate Reno Nv

Property has a tendency to appreciate in value over time, so if you make a smart investment, you you could look here can benefit when it comes time to sell. With time, rental fees additionally often tend to raise, which could raise capital. Leas raise when economies expand due to the fact that there is more demand for actual estate, which elevates capital worths.

One of the most eye-catching resources of easy earnings is rental earnings. One of the simplest techniques to keep a stable revenue after retirement is to do this. If you are still working, you may maximise your rental revenue by investing it following your financial goals. There are different tax advantages to real estate investing.

It will dramatically minimize taxed earnings while reducing the expense of genuine estate investing. Tax reductions are provided for a variety of costs, such as firm expenses, money circulation from various other assets, and mortgage interest.

Real estate's link to the various other primary possession teams is delicate, at times even negative. Genuine estate may as a result lower volatility and increase return on danger when it is consisted of in a portfolio of various assets. Compared to other properties like the stock exchange, gold, cryptocurrencies, and banks, purchasing realty can be considerably more secure.

Some Known Factual Statements About Real Estate Reno Nv

The stock exchange is continuously transforming. The property industry has actually grown over the previous a number of years as a result of the execution of RERA, decreased mortgage rates of interest, and other elements. Real Estate Reno NV. The rates of interest on financial institution cost savings accounts, on the other hand, are low, specifically when compared to the climbing inflation

Report this page